A Crude World

The Future of Oil: Geopolitics and OPEC+’s Diminishing Role

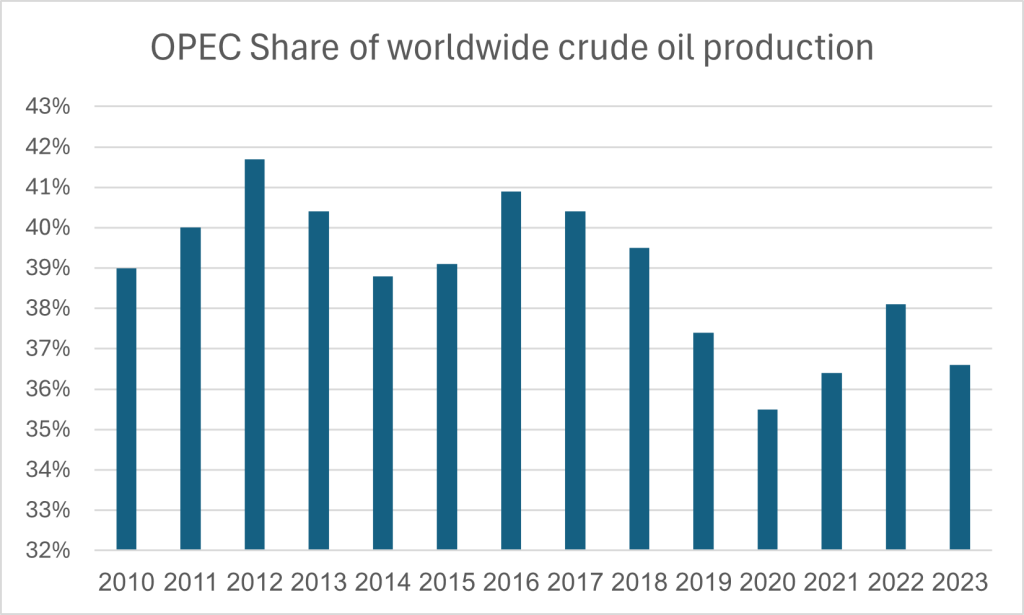

The global oil market is undergoing a transformative shift. Once dominated by the Organization of the Petroleum Exporting Countries (OPEC), along with its allies, collectively known as OPEC+, the cartel controlled a substantial portion of the world’s oil supply and had the power to influence prices. Yet, OPEC+’s influence is weakening as new energy technologies emerge, alternative energy sources gain traction, and geopolitical pressures intensify. I’ll attempt to examine the future of the global oil market through a realist lens, focusing on the declining influence of OPEC+, the role of China in this evolving landscape, and the risks of conflict in key oil-producing regions such as the Middle East and Russia.

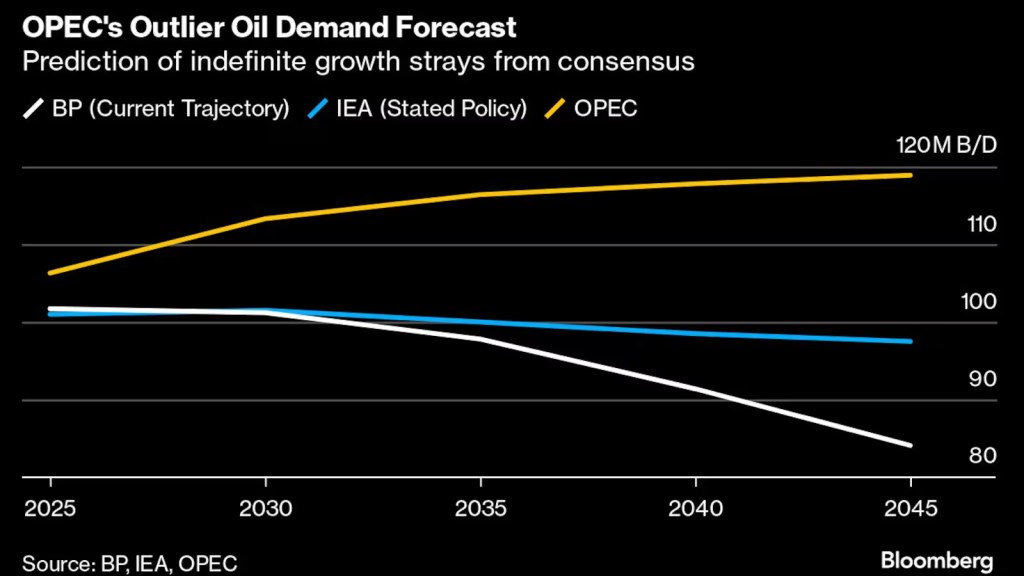

OPEC+ is steadily losing its grip on global oil markets as the world shifts toward renewable energy. This decline could lead to the fragmentation of the alliance, especially as major oil producers like Saudi Arabia, Iran, and Russia grapple with reduced oil revenues. Additionally, China’s evolving role, as it reduces its dependence on oil and accelerates its transition to renewable energy, will further diminish the power of OPEC+. The resulting economic challenges for oil-dependent nations could increase the risk of political instability and conflict in these regions.

OPEC+ and Its Evolving Role in the Global Oil Market

OPEC+, consisting of OPEC members and non-OPEC oil producers such as Russia, has historically used coordinated production cuts to stabilize global oil prices. However, several factors are eroding the organization’s ability to influence the global oil market.

1. The Rise of Non-OPEC Producers and Technological Advancements

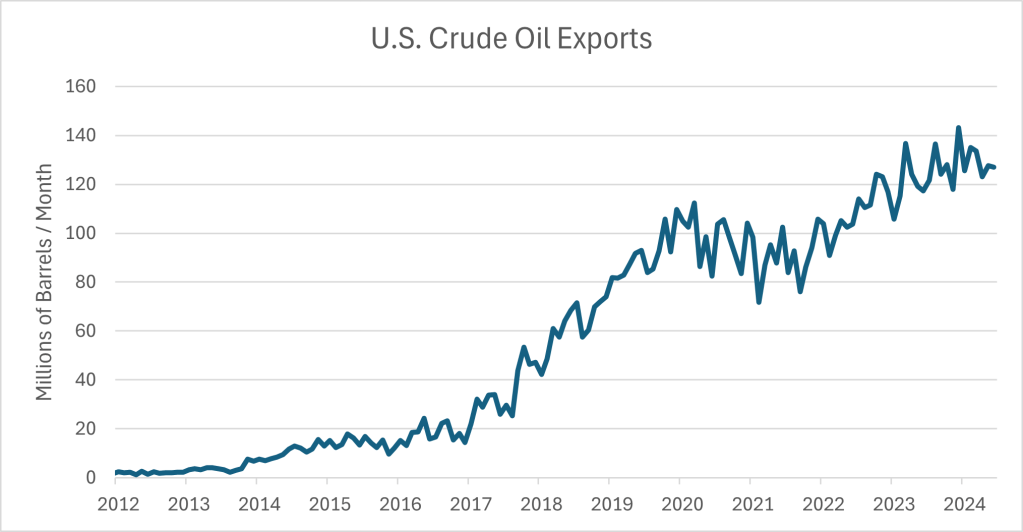

Non-OPEC oil producers, particularly the United States, have dramatically changed the global oil supply dynamics. The U.S. shale revolution, enabled by hydraulic fracturing (fracking) and horizontal drilling, has turned the U.S. into the world’s largest oil producer, with an output of around 12.9 million barrels per day (bpd) in 2023. This has reduced OPEC+’s control over global supply and prices.

Countries such as Brazil and Canada have also significantly increased their oil production, contributing to a more diversified supply base. Russia, which produces over 10 million bpd, remains a key player in OPEC+, but its economic and political interests often diverge from those of other members like Saudi Arabia, leading to tensions within the alliance.

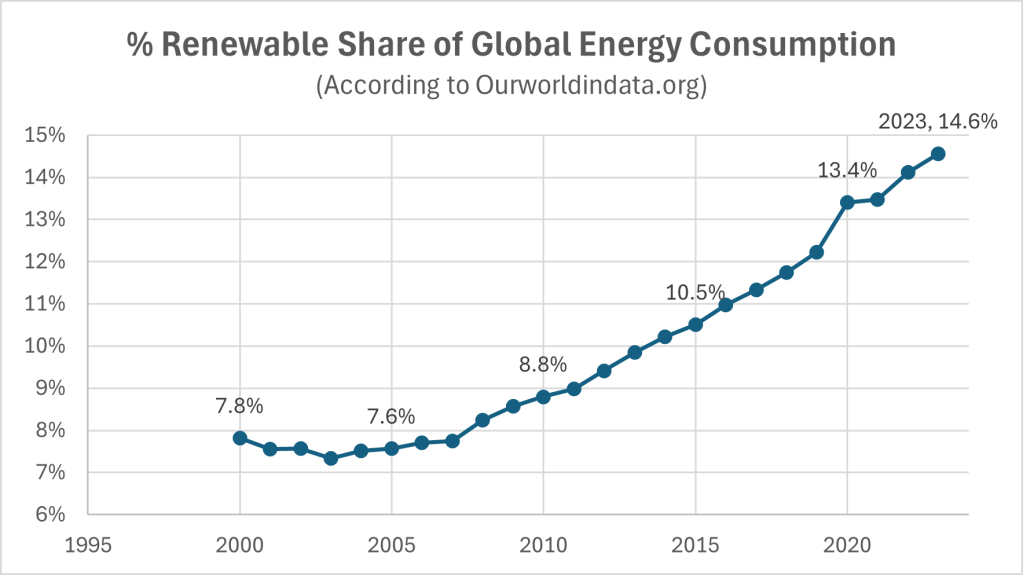

2. The Global Energy Transition and Declining Oil Demand

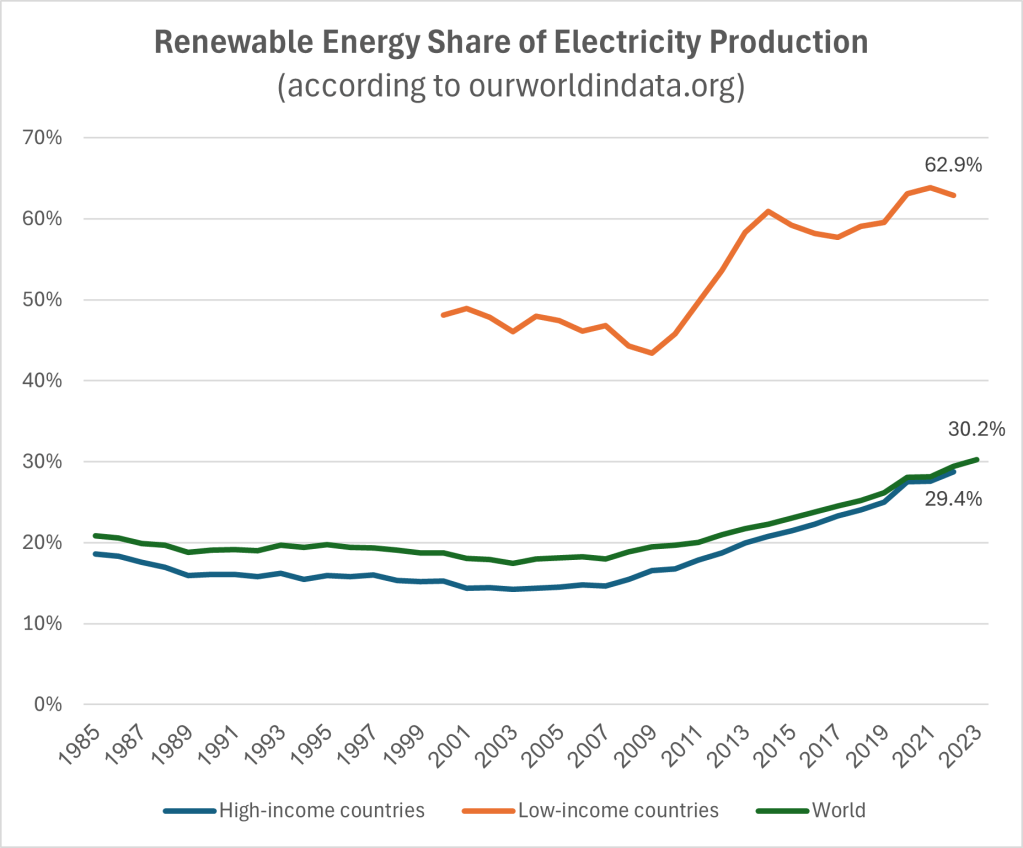

The world is steadily transitioning away from fossil fuels, driven by the need to address climate change and the falling costs of renewable energy. Solar and wind energy have become increasingly competitive with oil and natural gas, leading to their rapid adoption. According to the International Energy Agency (IEA), renewable energy will account for 95% of global power capacity growth between 2021 and 2025.

Additionally, electric vehicles (EVs) are gaining market share, particularly in Europe, the U.S., and China. Major car manufacturers have committed to phasing out internal combustion engine vehicles, with countries like the UK and Germany planning to ban the sale of new petrol and diesel cars by 2035. As the global transportation sector shifts toward EVs, oil’s dominance in this sector will decline, reducing overall demand for petroleum products and eroding OPEC+’s influence over the market.

3. Internal Tensions Within OPEC+

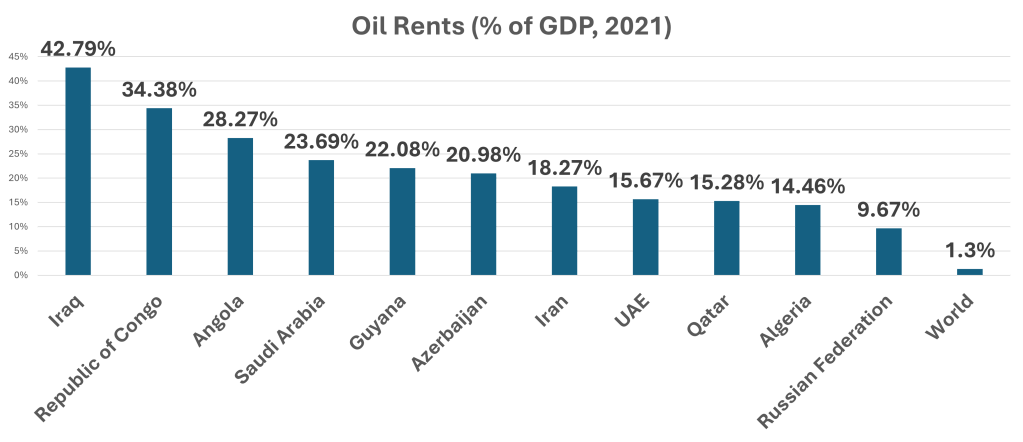

OPEC+ is increasingly divided as member states pursue their own national interests. Saudi Arabia, the largest oil producer in OPEC, relies heavily on oil revenues, which account for around 60% of its government budget. Riyadh consistently pushes for production cuts to stabilize prices, ensuring fiscal stability.

In contrast, Russia is less dependent on high oil prices and often prioritizes market share over price stability. Oil and gas account for approximately 30% of Russia’s federal budget and about 60% of its export earnings. While Russia cooperates with Saudi Arabia to balance the market, it has frequently exceeded its production limits, driven by short-term economic goals.

Iran, meanwhile, is heavily reliant on oil but has been severely constrained by U.S. sanctions, which have slashed its export capacity. Pre-sanctions, oil constituted around 70% of Iran’s government revenues; by 2022, this had dropped to approximately 30%. This has limited Tehran’s influence within OPEC+ while also creating pressures for Iran to push for higher prices.

China’s Role in the Global Oil Market

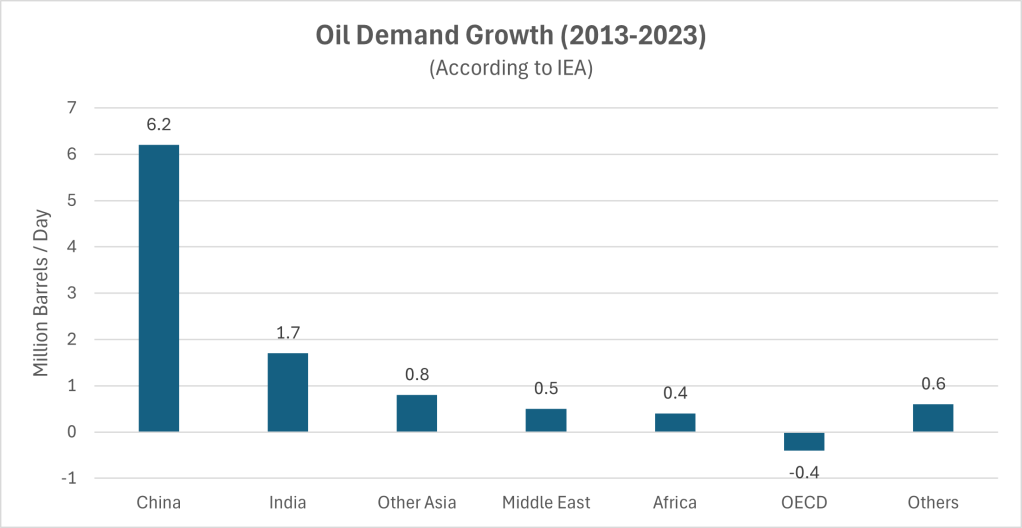

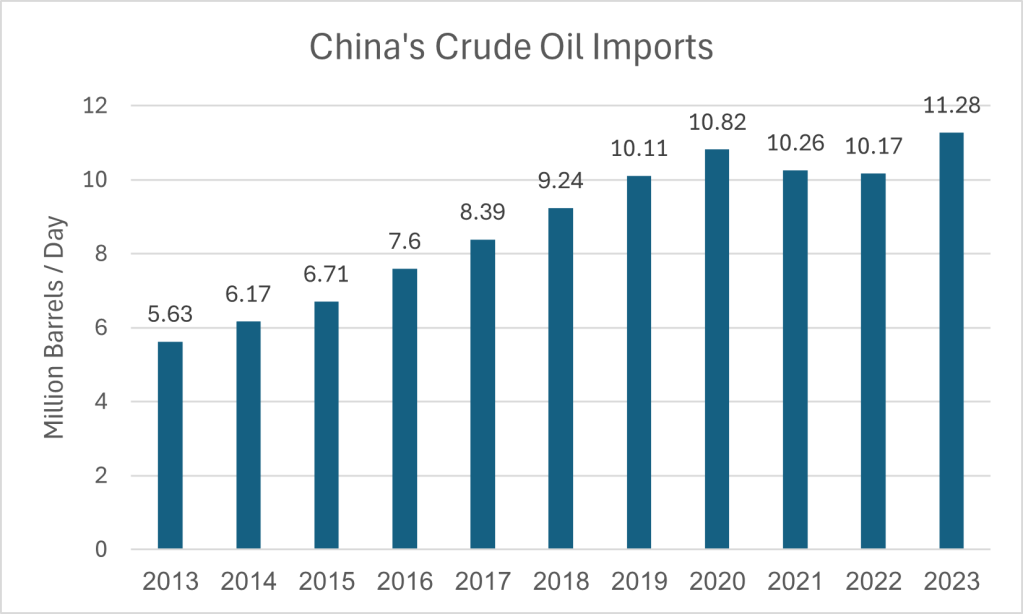

China plays a crucial role in the global oil market as one of the largest consumers of oil. However, its demand for oil is starting to slow as the country aggressively transitions to renewable energy sources and electric vehicles. China’s strategic energy policies and investments in clean energy are shaping the future of global oil demand, and this shift has significant implications for OPEC+.

1. China’s Demand for Oil and Its Strategic Importance

China is the world’s second-largest consumer of oil, behind the United States. In 2022, it consumed approximately 14 million barrels per day, making up roughly 15% of global oil demand. For years, China’s booming industrial sector, rapidly growing middle class, and expanding transportation needs fueled a surge in oil imports, making it a critical market for OPEC+ producers.

Saudi Arabia and Russia have been two of China’s largest suppliers. In 2022, Saudi Arabia exported approximately 1.75 million bpd to China, while Russia supplied around 1.72 million bpd. For both countries, China’s oil purchases are vital for maintaining export revenues and supporting their domestic economies.

2. Slowing Chinese Oil Demand

Despite China’s historical role as a key driver of global oil demand, recent data shows that its oil consumption is beginning to plateau. Several factors contribute to this trend:

- Economic Transition: China is transitioning from an industrial-led economy to one focused on services and technology. As heavy industries such as steel and cement production slow, demand for oil in these sectors has also tapered off.

- Renewable Energy Investment: China is the world’s largest investor in renewable energy. In 2022, China installed 100 gigawatts (GW) of solar and wind power capacity, more than any other country. The government’s goal is for renewable energy to account for 50% of its total energy consumption by 2030, reducing reliance on oil for power generation.

- Electric Vehicle Adoption: China is also the largest market for electric vehicles, with almost 60% of global EV registrations in 2023. The Chinese government aims for 20% of all car sales to be electric by 2025, further reducing the country’s dependence on oil for transportation. In the first half of 2023 alone, EVs made up nearly 25% of new car sales in China, showing a sharp acceleration in the country’s shift away from oil-dependent vehicles.

As China reduces its dependence on oil, the impact on global oil demand will be significant. The IEA predicts that China’s oil demand growth will slow to just 1.5% annually through 2025, a sharp decline from the rapid increases of previous decades. By 2030, Chinese oil demand is expected to peak and then begin declining as renewables and EVs take over larger shares of the energy and transportation markets.

3. Implications for OPEC+

China’s slowing demand for oil poses a serious challenge for OPEC+. As the world’s largest oil importers, countries like China have been crucial to OPEC+’s market strategy. Saudi Arabia, in particular, has developed close trade ties with China, and reduced Chinese demand could have a direct impact on its revenue.

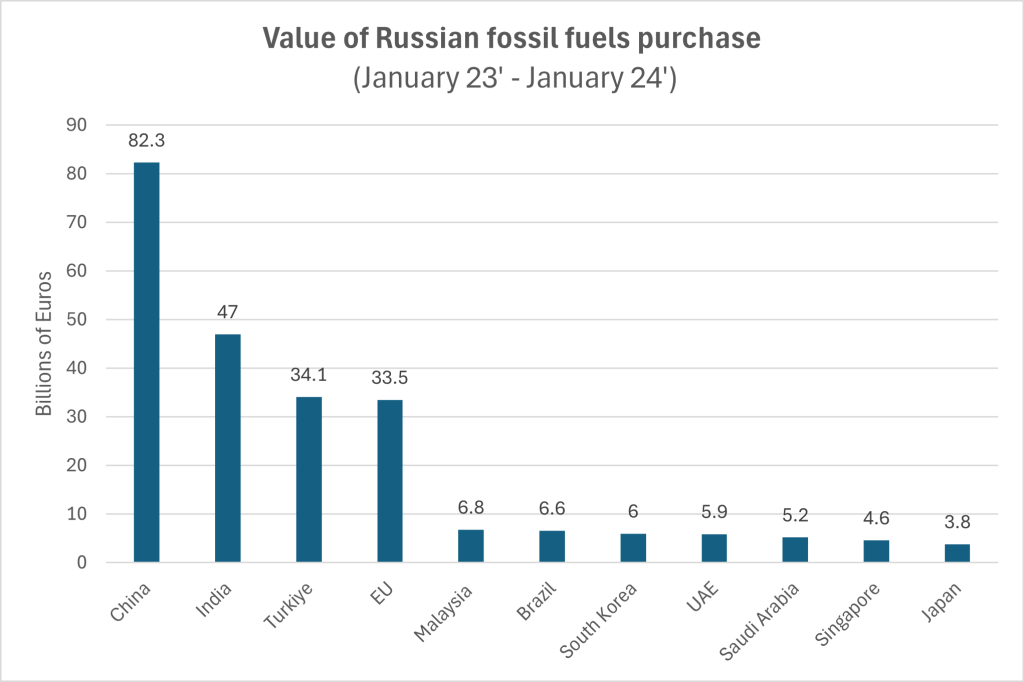

Additionally, Russia, which has relied on China to offset losses in European markets due to Western sanctions, will likely face significant economic strain if Chinese imports from Russia decrease. As China shifts toward renewable energy, OPEC+ members will need to find new buyers or adapt to a world where oil plays a diminishing role in global energy consumption.

The Realist Geopolitical Perspective on OPEC+’s Decline

From a realist standpoint, power is derived from the control of critical resources, and OPEC+’s ability to influence global oil markets has been a major source of geopolitical strength. But in recent times, the decline in oil demand, particularly from key consumers like China, is eroding OPEC+’s influence.

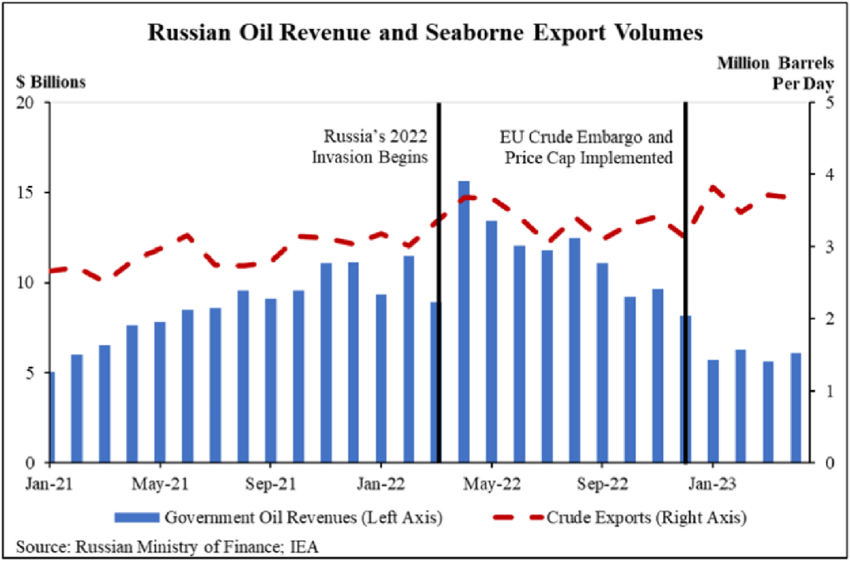

1. Russia’s Role and Economic Dependency on Oil

Russia is one of the most important members of OPEC+, with its economy heavily dependent on oil and gas exports. Oil alone accounts for around 60% of Russia’s export revenues, and the country’s federal budget relies on energy exports to fund its military and foreign policy ambitions. The 2022 war in Ukraine and subsequent Western sanctions have hit Russia’s economy, but its oil and gas exports to China and India have allowed Moscow to maintain some level of economic stability.

However, as China reduces its oil imports in the coming decades, Russia’s reliance on the Chinese market may prove unsustainable. Moscow will need to either diversify its economy or find alternative markets, neither of which offers a quick fix. The long-term outlook for Russia’s oil sector is challenging, particularly if global oil demand peaks and declines in the next decade.

2. Saudi Arabia’s Economic Diversification and Vulnerability

Saudi Arabia is deeply reliant on oil, with petroleum accounting for most of its fiscal revenues. The kingdom has recognized this vulnerability and launched Vision 2030, a sweeping economic diversification plan aimed at reducing dependence on oil by developing industries like tourism, technology, and renewable energy.

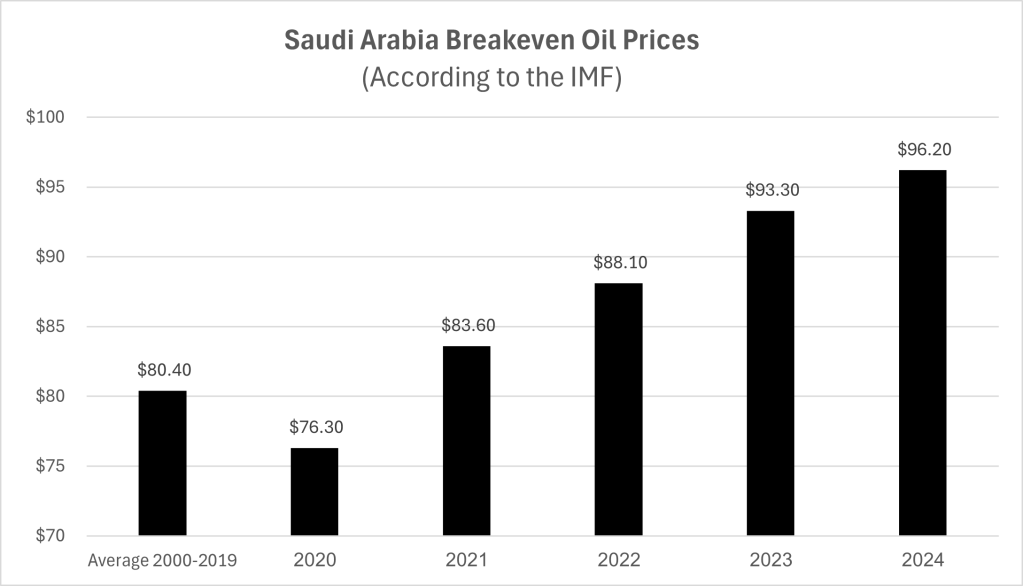

While Vision 2030 has ambitious goals, its success is far from guaranteed. Saudi Arabia’s breakeven oil price is estimated at around $96 per barrel, while current projections see the average Brent oil price at 81.52$ per barrel. The Saudi Kingdom is thus vulnerable to price fluctuations which could hinder their progress towards their Vision 2030. A prolonged period of low oil prices, coupled with declining demand from key markets like China, will strain the kingdom’s finances, jeopardizing domestic stability and its ability to maintain its role as a regional power.

3. Iran’s Struggles Amid Sanctions and Oil Market Shifts

Iran’s economy has been severely constrained by U.S. sanctions, which have drastically reduced its oil exports. While China has continued to buy Iranian oil, the reduced global demand for oil presents a significant challenge for Tehran. Before sanctions, oil made up around 70% of Iran’s government revenues; this has dropped to around 30% in recent years, forcing Iran to find alternative revenue sources.

The decline in oil revenues has weakened Iran’s geopolitical influence in the Middle East, limiting its ability to fund proxy groups and regional allies. As oil becomes less important in global markets, Iran’s ability to project power through its oil wealth will diminish further.

The Future of OPEC+ and the Risk of Fragmentation

Given the internal and external pressures on OPEC+, the alliance faces the real possibility of fragmentation in the coming years. Several key factors contribute to this risk:

1. Diverging National Interests and Quota Non-Compliance

Member states’ interests often diverge, with countries like Saudi Arabia and Russia prioritizing different outcomes. While Saudi Arabia aims for higher oil prices through production cuts, Russia has been more focused on maintaining market share. These differences make it difficult for OPEC+ to act in unison, and non-compliance with production quotas further erodes the group’s ability to influence prices.

2. The Global Energy Transition and Irrelevance of OPEC+

As renewable energy and electric vehicles become more prevalent, global oil demand is expected to peak and then decline. The IEA predicts that global oil demand will plateau by the late 2020s, with a gradual decline thereafter. In this new energy landscape, OPEC+ will become increasingly irrelevant, with its ability to control oil markets fading as demand decreases.

The Risk of Conflict in Oil-Dependent Regions

As OPEC+ declines and oil revenues shrink, the risk of instability in oil-dependent regions will increase. This is particularly true for the Middle East and Russia, where oil wealth has underpinned political stability for decades.

1. Economic Instability and Domestic Unrest

In many Arab countries, oil revenues have supported a system of “rentierism,” where the state derives its income from the export of natural resources rather than taxing its citizens. This has allowed oil-rich Arab states like Saudi Arabia to establish social contracts with their populations, providing generous subsidies, social welfare programs, and guaranteed public sector employment in exchange for political quiescence. Similarly, in low-income countries like Iraq and Libya, oil revenues may help stabilize post-conflict recovery efforts, avoiding further violence. Citizens, in return, have tolerated limited political participation and authoritarian governance, so long as their material needs are met.

When oil revenues decline, these governments can no longer afford such extensive welfare programs or public sector salaries. Economic austerity measures—like subsidy cuts, tax increases, and reductions in public employment—often provoke widespread public anger. In oil-dependent economies, these sudden changes to the social contract can lead to political unrest.

2. Interstate Rivalries and Proxy Conflicts

As oil revenues shrink, regional powers such as Saudi Arabia and Iran would likely seek to assert their influence through more aggressive foreign policies. Their current regional power depends on oil revenues to fuel their economy and support their expensive armies, with Iran and Saudi defense expenditure comprising around 25% and 27% of their national budget, respectively. Proxy conflicts, like those in Yemen and Syria, could intensify as both nations compete for regional dominance in the face of declining oil revenues.

3. Shifting Power Dynamics and Global Realignment

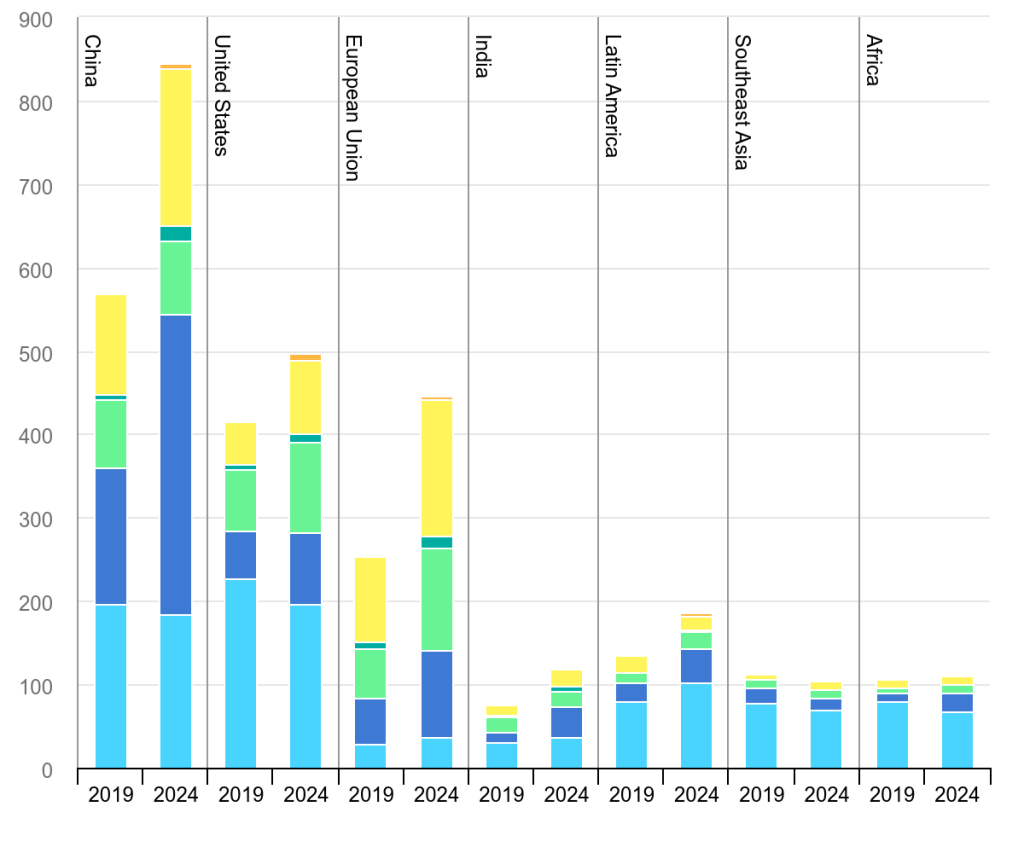

The decline of oil as a strategic resource will also reshape global alliances. Countries investing heavily in clean energy, like China and the EU, may emerge as new power centers, while traditional oil powers like Saudi Arabia and Russia will need to adapt to new geopolitical realities. The status of the U.S. is of particular interest in this regard, with it being both a major fossil fuel producer and a big investor in clean energy.

(Billion USD)

Conclusion

The future of the global oil market is undergoing a significant transformation. OPEC+, once a dominant force in controlling oil supply and prices, is facing internal divisions, external competition, and the global shift toward renewable energy. China’s role, as it transitions from oil to cleaner energy sources, will further erode OPEC+’s influence.

For key oil producers like Saudi Arabia, Russia, and Iran, the decline in oil demand presents significant risks, including economic instability, political unrest, and heightened geopolitical tensions. As the world moves away from oil, these countries will need to navigate the challenges of reduced revenues and adapt to a new energy landscape. Furthermore, I suspect the decline of OPEC+ will lead to increased conflict in oil-dependent regions and shift global power dynamics as new energy technologies reshape the geopolitical landscape.

Leave a comment